Get started with T3Express

T3Express works differently than our other software products. It uses a paid points system, which is managed by our companion site www.docsign.ca. That means you don't need to retrieve or activate a license for T3Express software. Feel free to download and explore the software before purchasing points.

To efile or print a T3 return, you'll need to have 400 points ready, which equals $40.00 plus GST/HST. Make sure to purchase sufficient points beforehand. Follow these steps to do so.

Step 1: Get Efiler ID from CRA

Get an Efiler ID and password from CRA.

No Efiler ID? No problem! We can file your prepared T3 return for you for an additional 100 points ($10.00 + GST/HST). If you need assistance with filing, please don't hesitate to contact us when the return is ready and we'll be happy to help! In this case, start with Step 2 directly.

Step 2: Register a docsign.ca account

If you don't have a docsign.ca account yet, please register a free account first. Read the "What is docsign.ca" page for details and the registration link to complete it.

Step 3: Preference Setup in the software

Download and install T3Express from our website first.

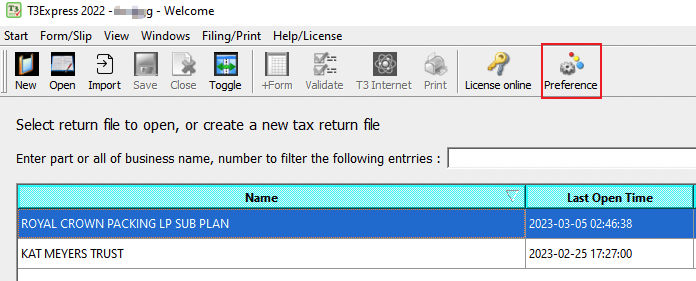

After installation, launch the software. Click the Preference icon first to set up the software.

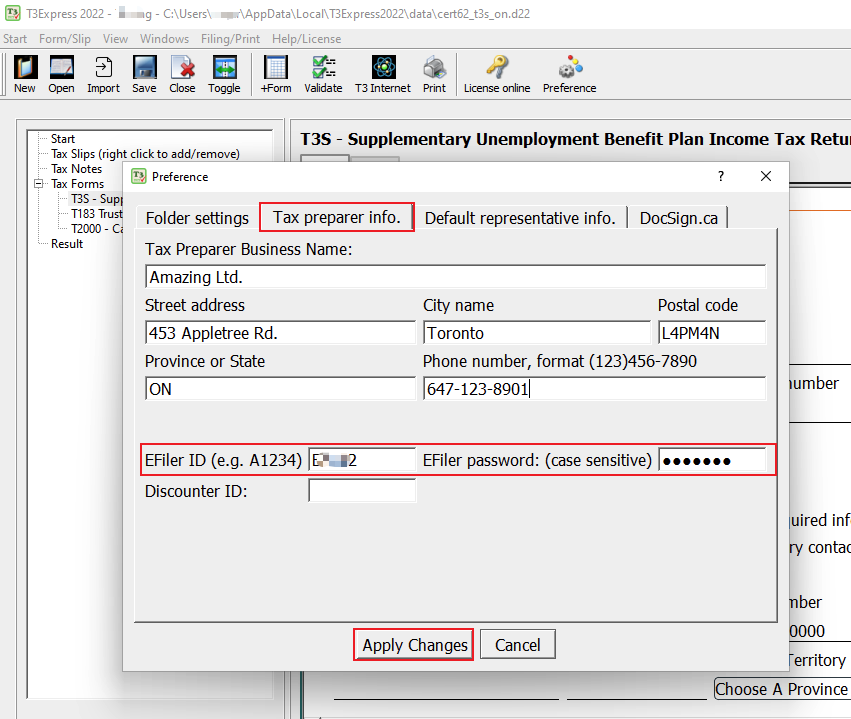

On the Tax preparer info. tab, enter your Efiler ID and password. Skip this if you don't have such information yet and we can help you file the return if needed.

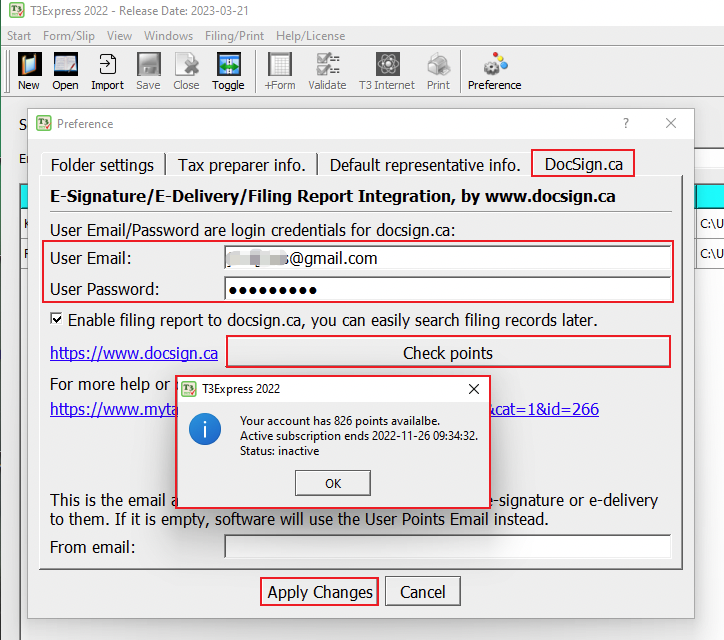

On the DocSign.ca tab, enter the email and password you have registered at docsign.ca.

To test the connection between the software and the docsign.ca website, click the Check points button.

- If you see a message box with available points, you have entered the correct email and password. A minimum of 400 points is required for a T3 return.

- If you see a login failed or error message instead, verify the email/password by logging on to the website directly in a browser: https://www.docsign.ca/login.

- You can reset your docsign password by following the instructions on this FAQ if needed.

- Don't forget to click the Apply Changes button at the bottom to save all information.

Don't forget to click the Apply Changes button at the bottom to save all information.

Step 4: Create a new return or import return

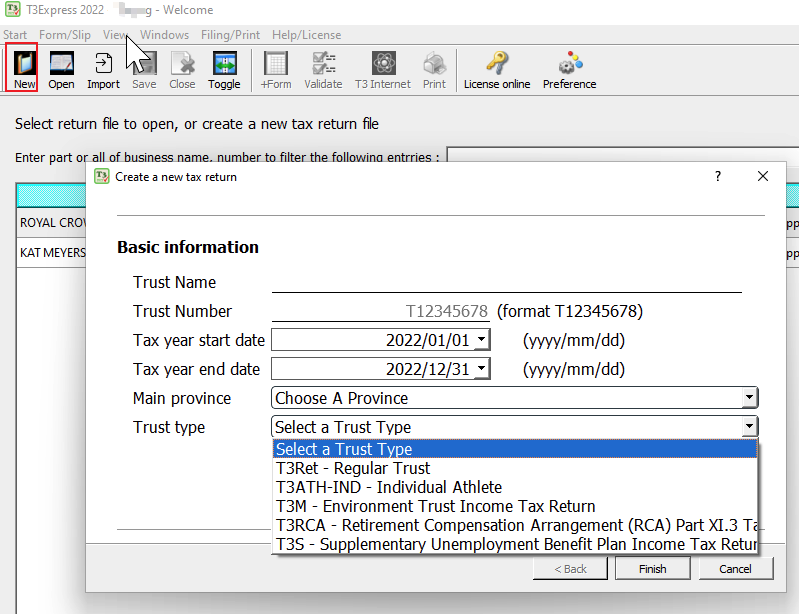

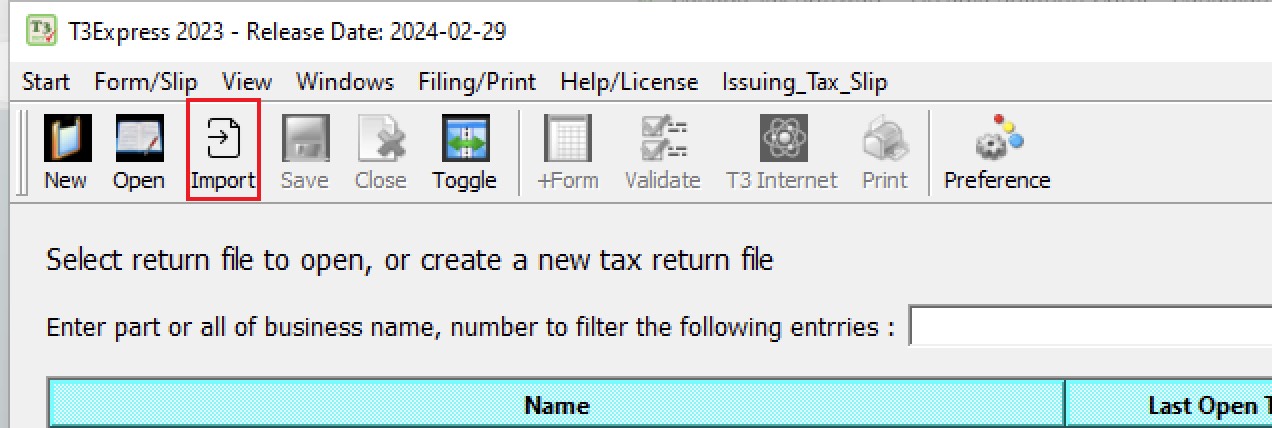

All prep work and setup in the software are completed now. You can start to create a new return by clicking on the New icon or the menu Start | New Return.

You can also import last year's return if you used our software last year by clicking the Import icon or the menu Start | Import last year's return.

Step 5: Validate and Efile T3 Return Online

Please read the instructions on how to validate and efile a T3 return online.

Related FAQs

- Validate and EFile a T3 return

- How to print a T3 return?

- Issue T3 slip/summary with T3Express

- What is docsign.ca?

- How to purchase points on docsign.ca?

- How to reset or change my docsign.ca password?