Auto-fill tax data in T2Express

In T2Express software, you can use the auto-fill function to fetch tax data from CRA. Here is a short video to demo the process, especially creating a new return based on the fetched .cor file you filed in prior tax years.

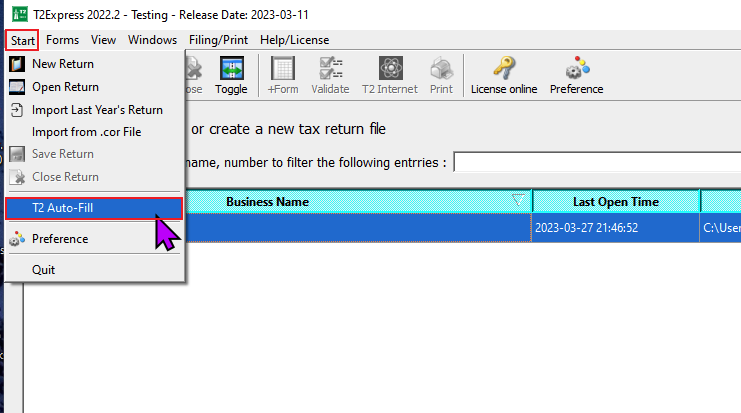

Step 1: Click the menu Start > T2 Auto-Fill option.

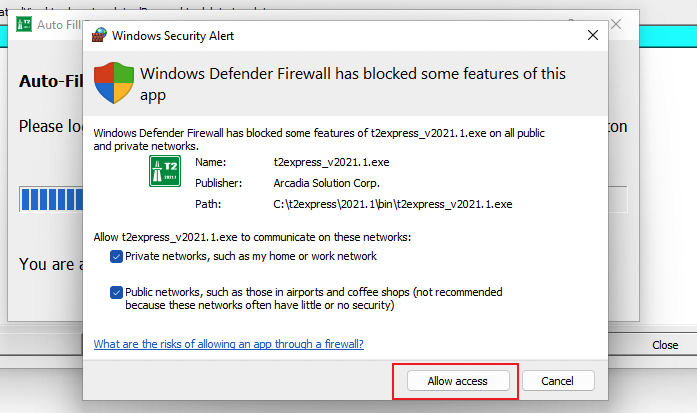

You may need to allow the software to access the network on your computer for the first time as the software needs to connect to the CRA server.

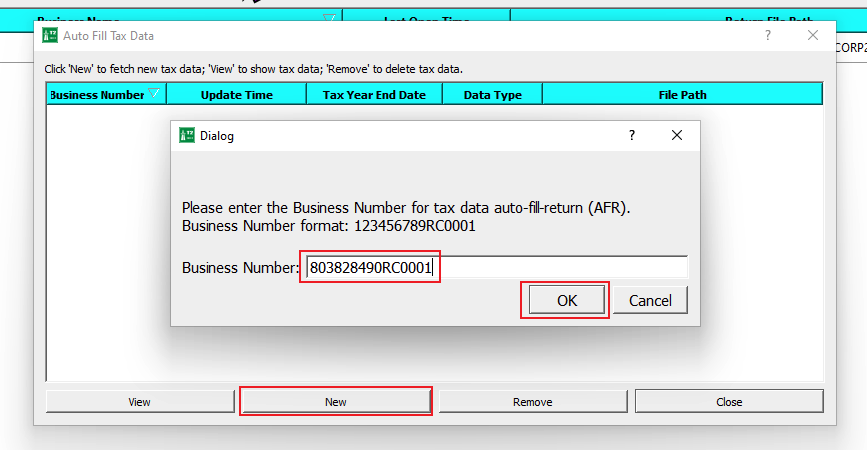

Step 2: An Auto Fill Tax Data window pops up. Click the New button and enter the Business Number in the field. Click the OK button to proceed.

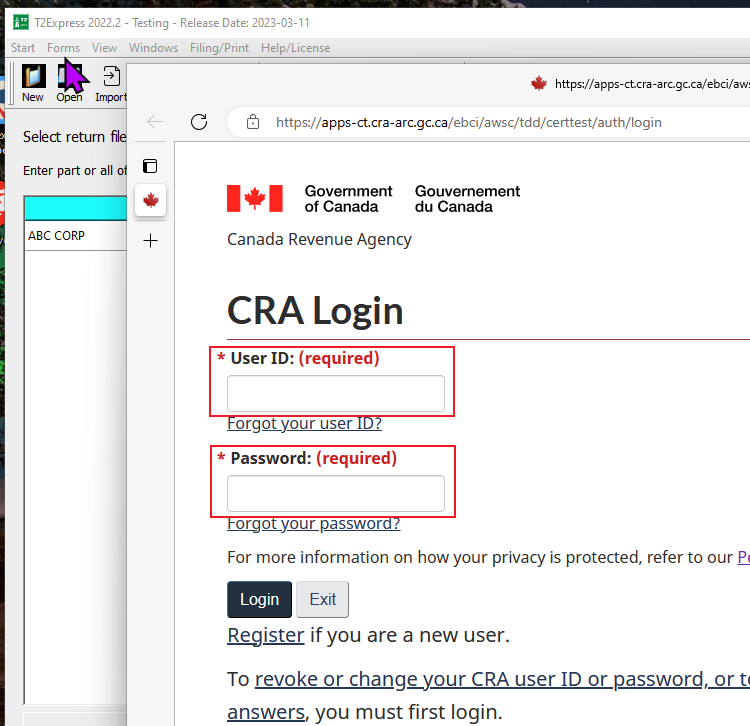

Step 3: The software will launch the default browser on your computer on the CRA login page. Enter the User ID and Password to log in to your CRA account.

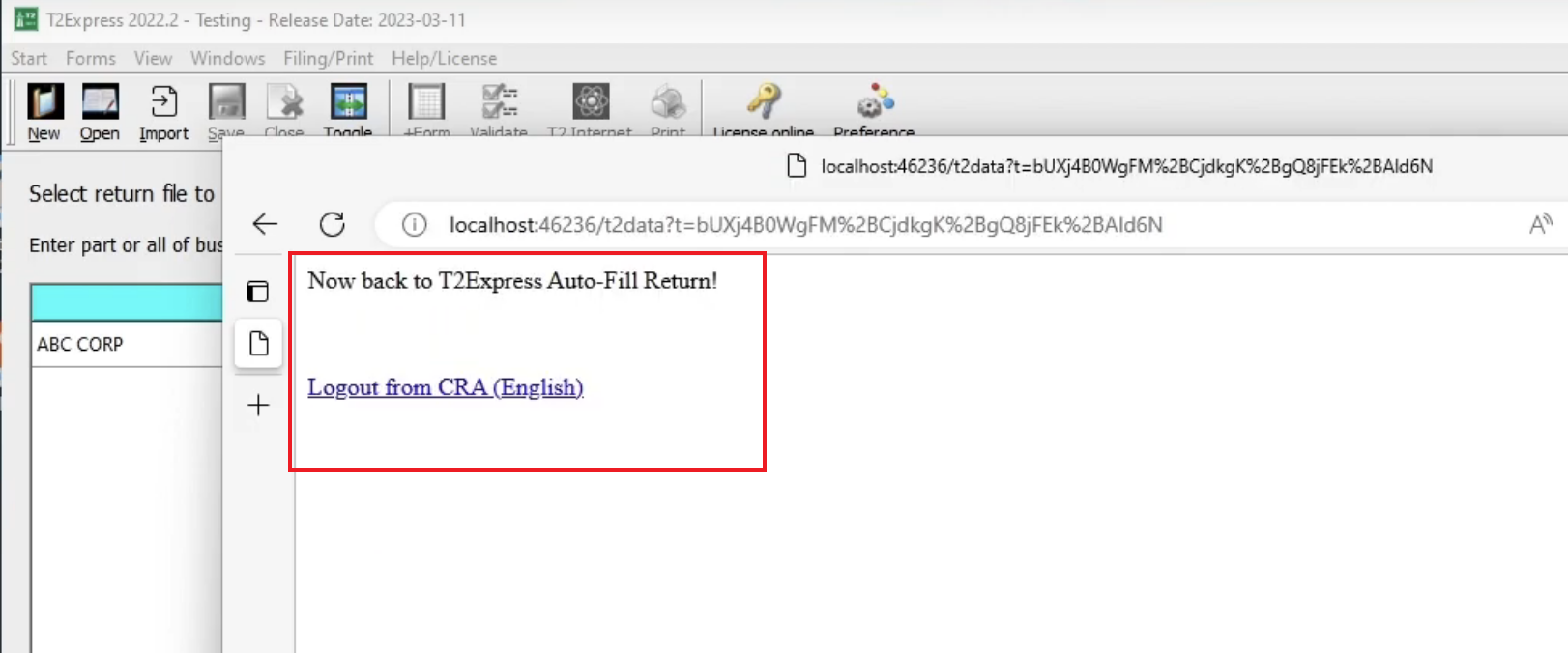

It may take a while to load in the browser, but eventually, you should see a web page similar to the following. Don't click the Logout from CRA, just keep the browser open to keep the connection session active.

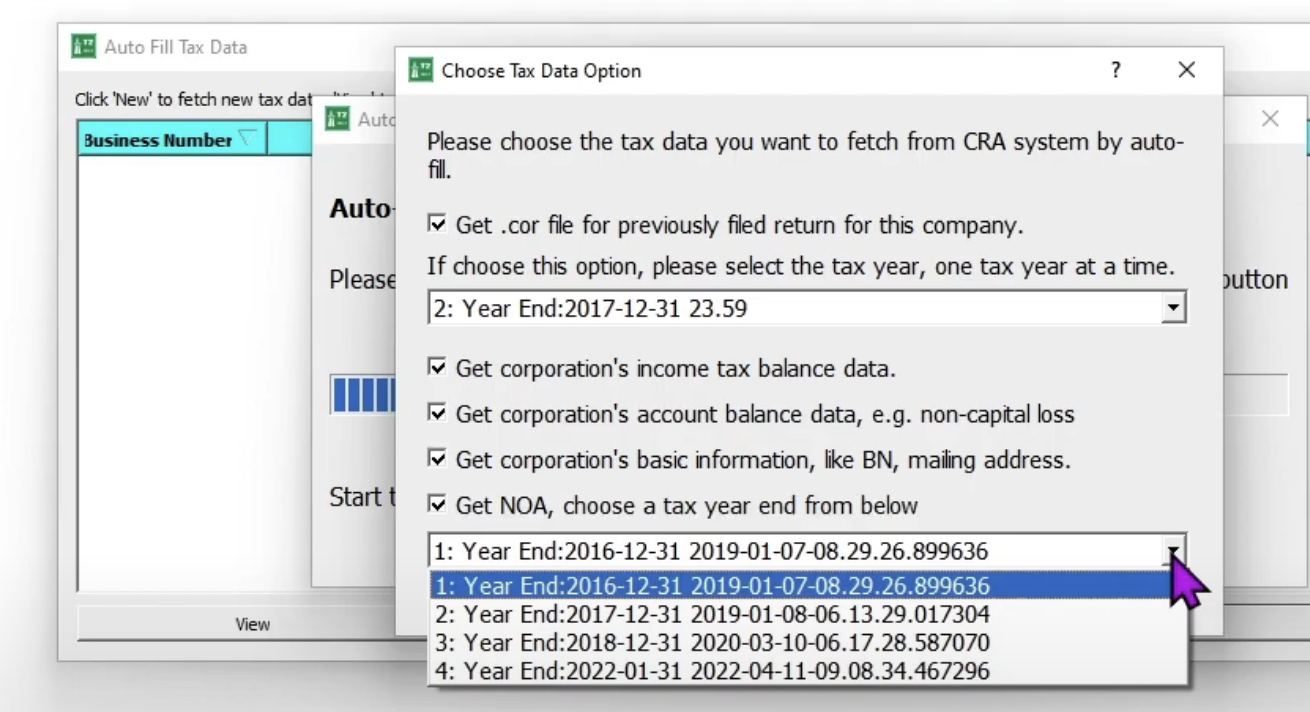

Step 4: Now click the software window, and a new Choose Tax Data Option is presented with all tax data files available. Choose the tax data you want to fetch. Click the OK button to proceed.

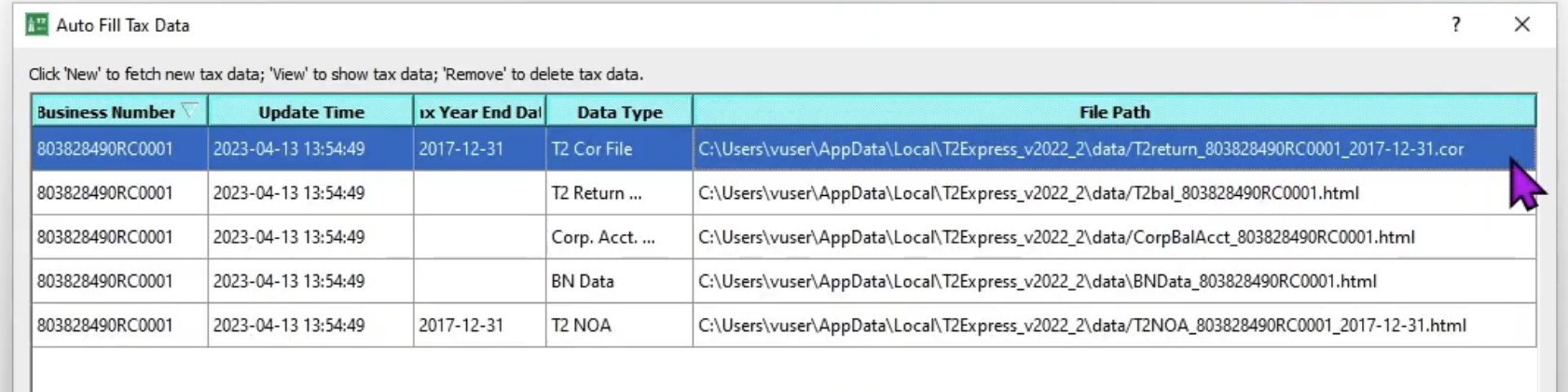

Step 5: Fetched files are listed with file paths that files are saved/stored on your computer. In the following screenshot, the .cor file is saved in the C:\Users\vuser\AppData\Local\T2Express_v2022_2\data folder.

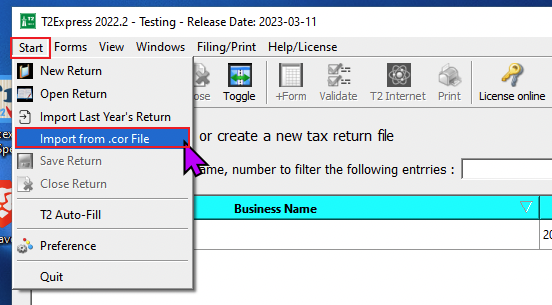

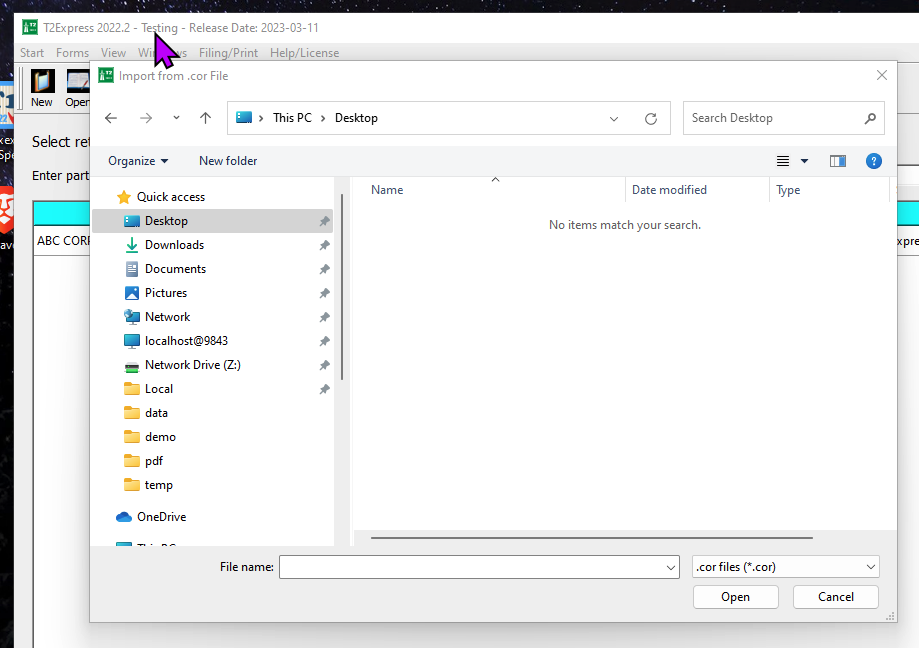

Step 6 (Optional): We can use the fetched .cor file (the tax year 2017) to create a new return by clicking the menu Start > Import from .cor file option.

The File Explorer pops up, navigate the folder above C:\Users\vuser\AppData\Local\T2Express_v2022_2\data folder, then select the .cor file

A new return will be created based on the .cor file. Ensure to update the start/end dates of the tax year and save the return.