How to choose T2Express version?

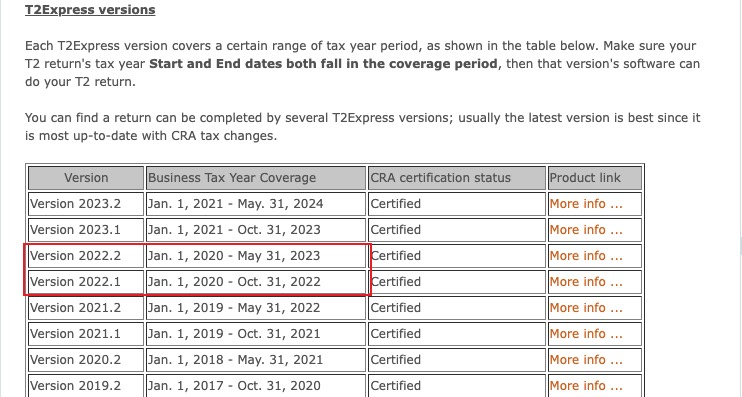

Each version of T2Express software is designed to handle tax returns for a specific period, typically around 3 years. If a tax year start/end date falls in the coverage range of a version, that version can be used to complete and file the tax return for that year.

You may find that multiple T2Express versions can be used to complete a return. In most cases, the latest version is the best choice, as it includes the most up-to-date information on tax changes from the Canada Revenue Agency (CRA).

A list of all T2Express versions along with their coverage details can be found on the T2Express Home page.

For example, let's say you need to file a 2020 tax return for a company that had a tax year from September 1 to August 31. According to the coverage table on the homepage, both Version 2022.1 and Version 2022.2 can handle this return. However, we'll go with Version 2022.2 since it covers a slightly longer tax period, which is useful if you also plan to work on next year's returns.