Validate and EFile a T3 return

In the software, you can use the menu Form/Slip to add slips or forms (or the +Form icon for forms) if needed.

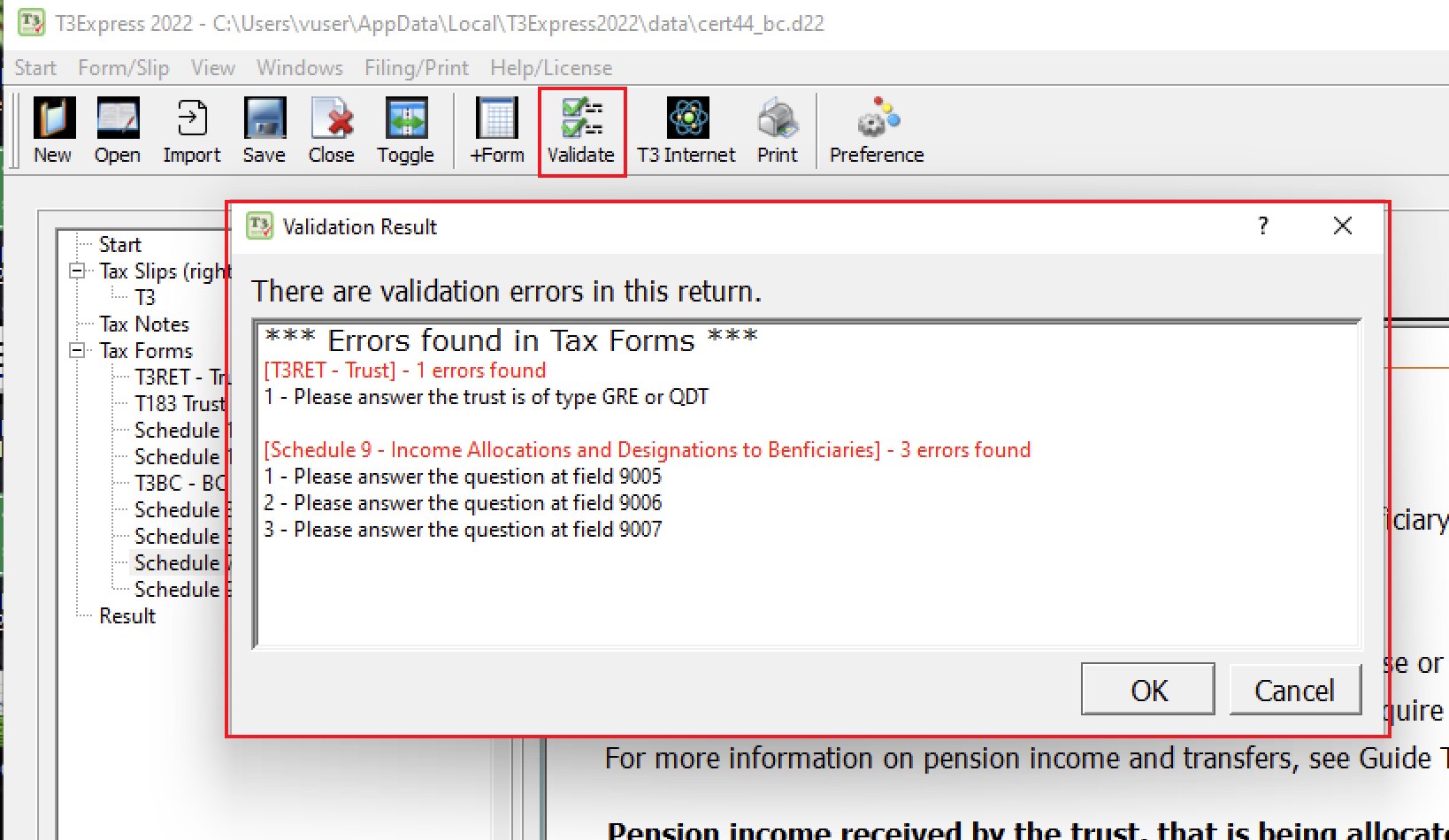

Validate the Return

When working on a T3 return, you can always use the Validate Return tool in the software for assistance. The software will cross-check all forms and list errors found on each form.

Each message tells you which form and what you should fix on that form. Follow error messages one by one to fix them.

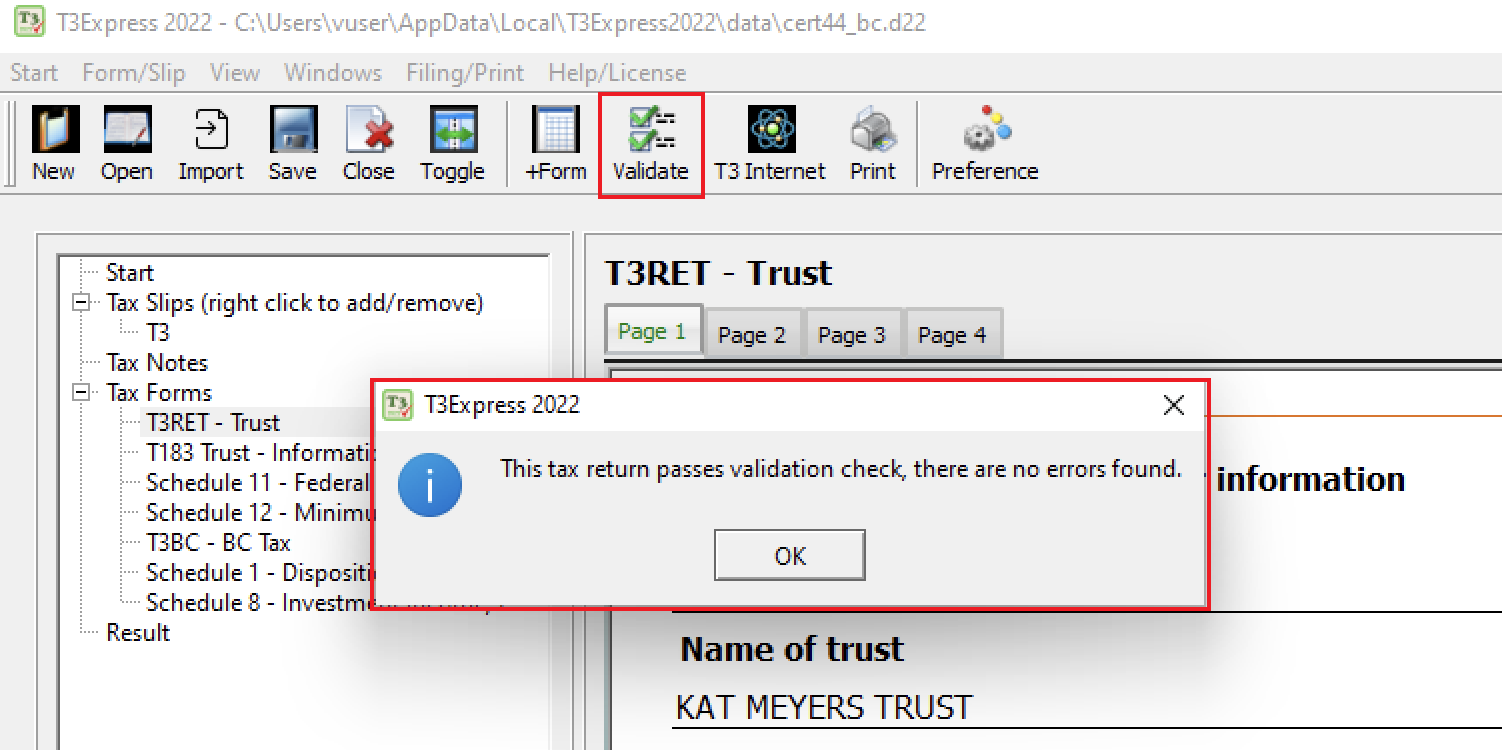

If no errors are found, it means the return is ready to file.

EFile the Return

We can efile a prepared T3 return on your behalf with an extra 100 points (equivalent to $10.00 + GST/HST) if you don't have an Efiler ID.

When you attempt to efile or print a T3 return, the software checks the combination of the trust account and tax year start/end dates to determine if it's a new or existing return. If these details remain unchanged, the software treats it as the same return and deducts 400 points from your docsign account only the first time. However, if you modify any of these fields later and want to print/efile again, the software considers it a new return and will attempt to deduct another 400 points from your account. Therefore, before printing or efiling a new return, double-check the accuracy of the trust account and tax year start/end date fields to avoid unnecessary points deduction from your account.

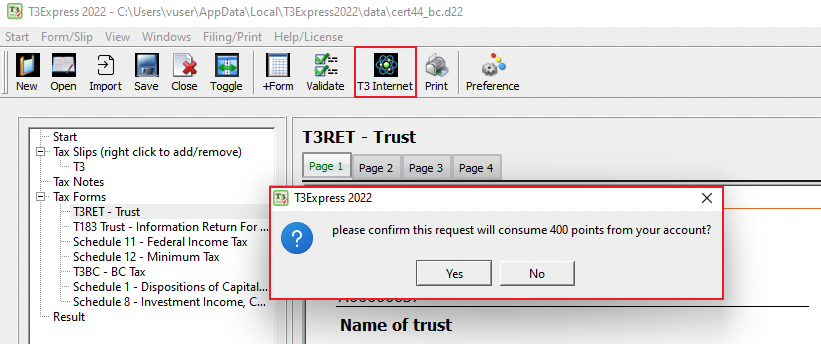

If your return is validated without errors, you can use the menu Filing/Print > T3 Internet Filing or the T3 Internet icon to file the return in the software.

A pop-up message will appear reminding you that 400 points will be deducted. To proceed, click the Yes button. After submitting, another pop-up message will inform you whether the filing was successful or if there were any errors returned by CRA.

Relevant FAQs

- Get started with T3Express

- How to print a T3 return?

- Issue T3 slip/summary with T3Express

- What is docsign.ca?

- How to purchase points on docsign.ca?