How to report T5008 slip?

Note

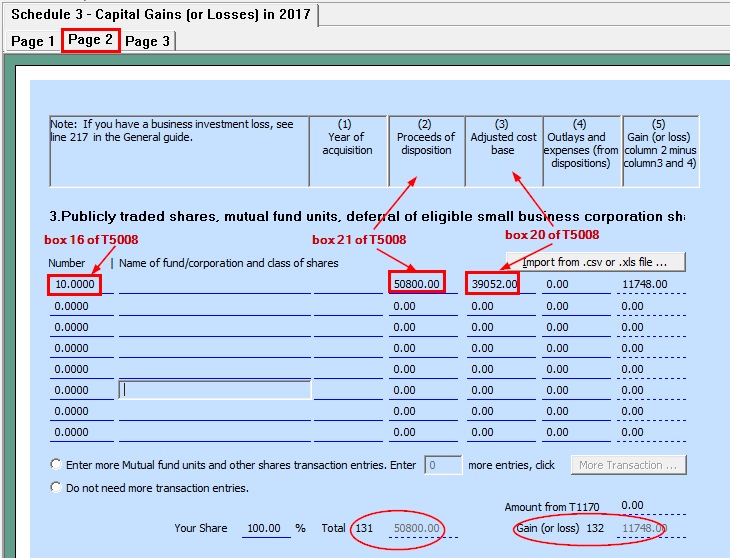

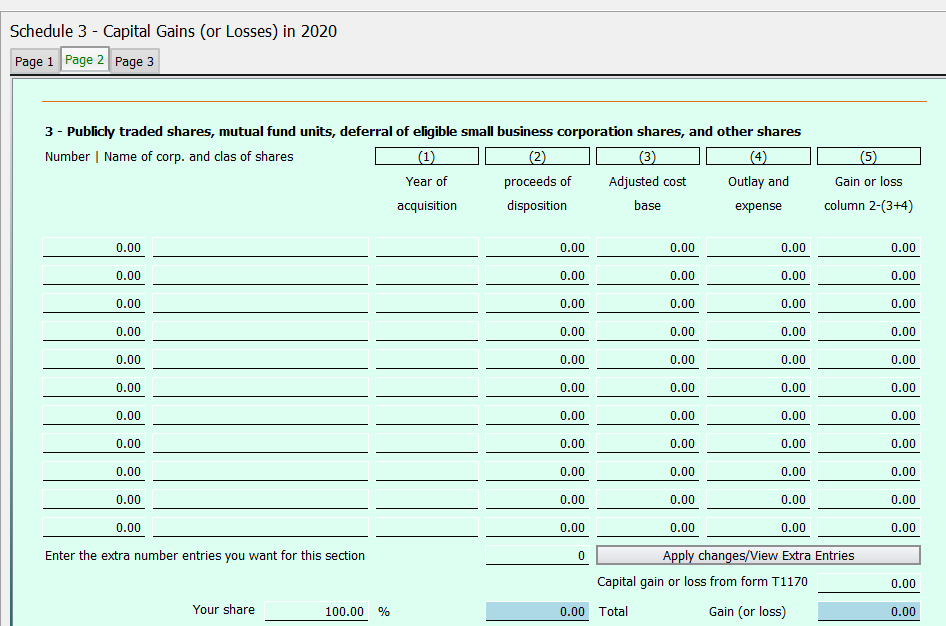

The basic procedure is still applicable to Version 2020 and later. However, the number for each field is changed to a 5-digit format from the Year 2019 by CRA. Hence, field 131 is now labeled as 13199, and field 132 is now labeled as 13200.

T5008 slip is not used directly in a tax return. you need to add form Schedule 3 in your tax return and enter each stock/mutual fund transaction into an entry of field 131/132.

Each T5008 will become one entry of transaction for field 131/132. You need to find out the amounts in T5008:

- The number of shares in schedule 3, is box 16 of T5008

- cost base, the buying price, is box 20 of T5008

- disposition, the selling price, is box 21 of T5008

- outlay and expense, the commission you pay to buy/sell if any